On this page, you state which loans / forms of financing the company already has with your bank and whether there are other loans / forms of financing with other banks.

Enter as detailed as possible regarding interest rates, fees, etc. If you do not have information about interest rates, fees, you can enter the same terms and conditions as the Bank offers for the same type of financing.

What you enter here is included for future forecasts regarding amortization and interest expenses.

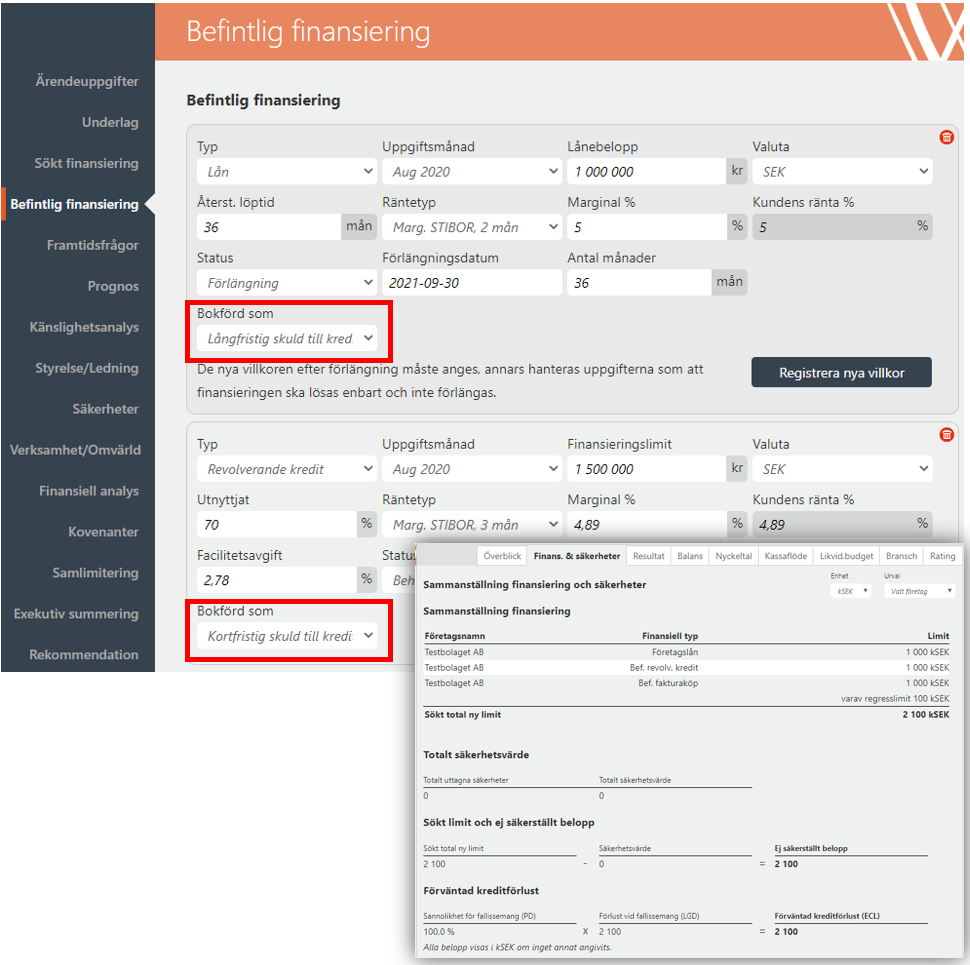

Note! Revolving credit is equated as "Short-term debt credit institution / Kortfristig skuld till kreditinstitut" according to our data model and "Loan" is "Long-term debt to credit institution / Långfristig skuld till Kreditinsitut". This means that if the customer posted it differently in their accounting, you need to adjust it so that it matches what the customer has "Posted as / Bokförd som". Otherwise, there is a risk that forecast models and cash flow will have the wrong outcome. You do this by choosing what it should be "Posted as / Bokförd som" in the dropdown (see picture below).

You can choose from five different "Status":

"Förlängs" / "Extension" - you use this when you have a financing that you have to make a decision about regarding extension. Select the date of the extension and enter the number of months

"Löses" / "Repay" - you enter information about a loan to be redeemed and specify when it is to be redeemed

"Behålls" / "Keep" - it is an existing loan that must remain with the same terms as already stated for the loan.

Årsföredragning / Annul review - it is an existing financing that is subject to a yearly review.

Beviljad / Approved - it is a financing that has been approved but not paid out to the company

All new and existing financing available at the bank for the company is presented on the right side under the tab "Finans & säkerheter" / "Finance & collateral" so you get a clear overview.

Picture from the program