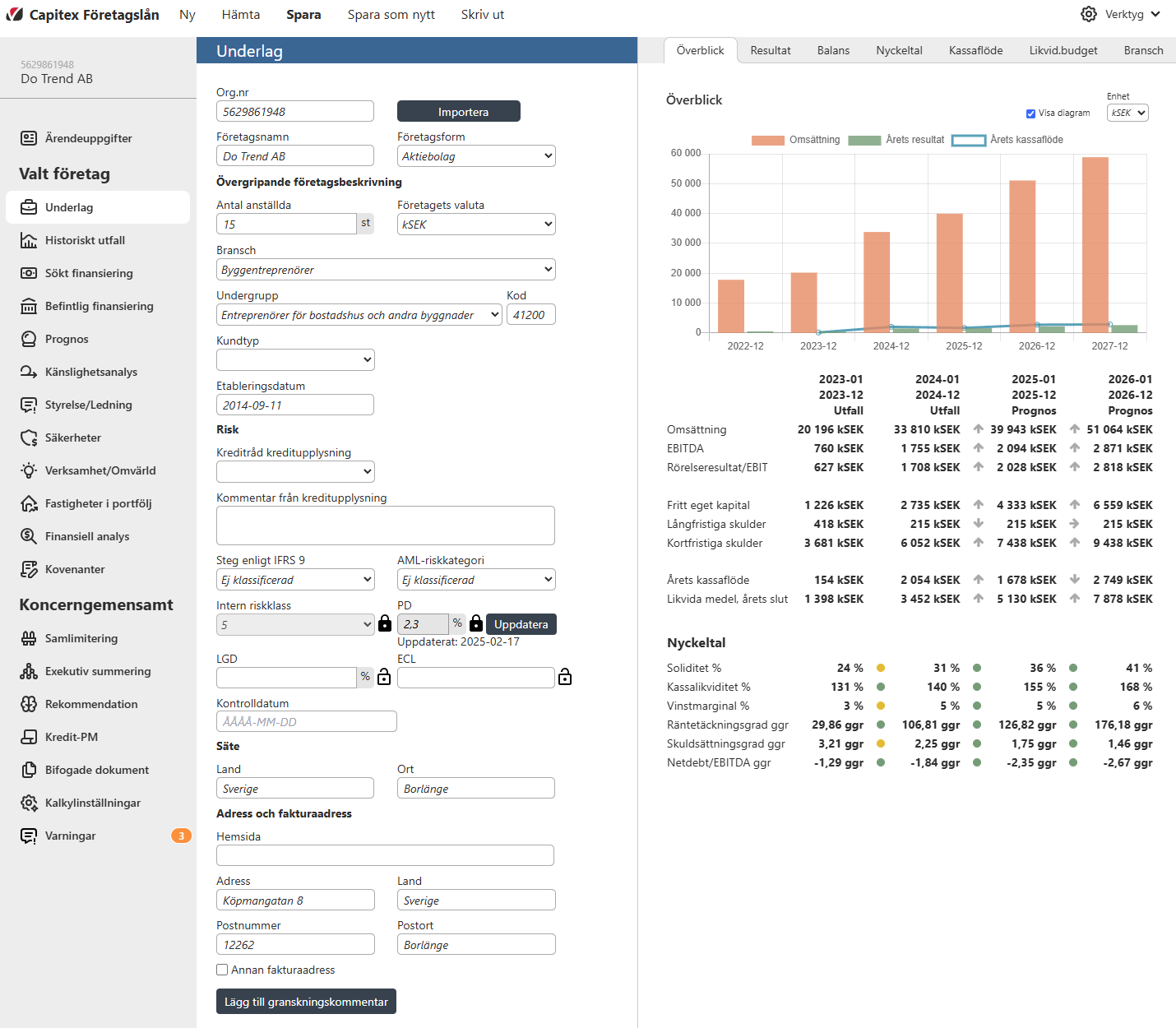

User manual for Capitex Business Loan

The information regarding the User manual is for a full version (one of many different configurations) of the application and some parts may be modules that your bank doesn't have access to. If you see functionality that you don't have access to contact the department/person responsibly for Capitex Företagslån at your bank.