This is an optional module and is not active on all configurations. If you want more information about this module please contact Vitec Capitex.

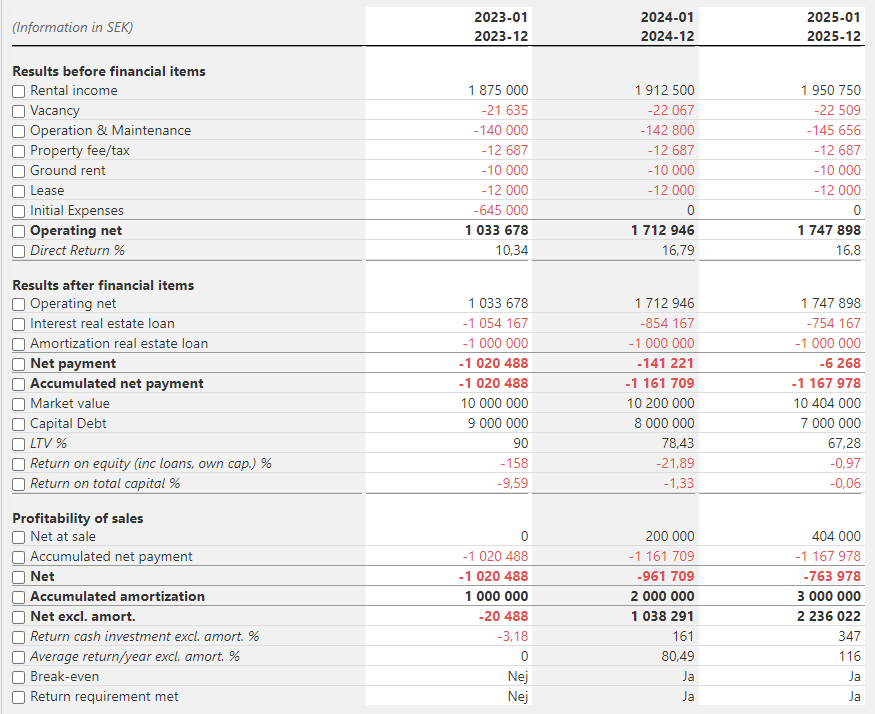

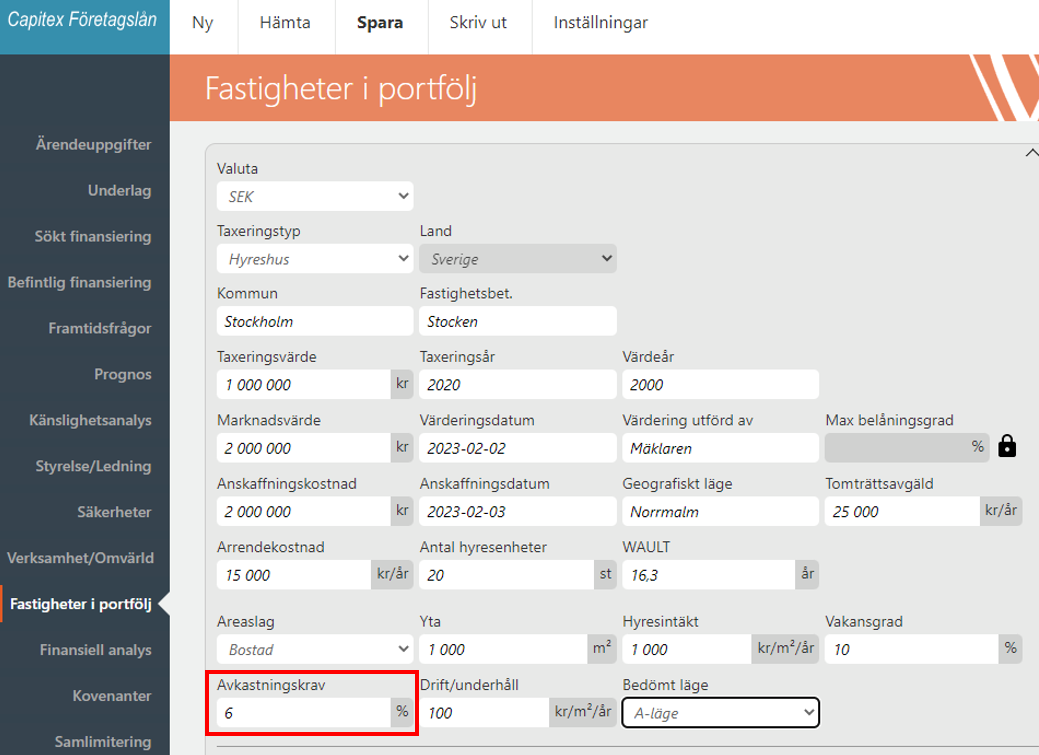

Cash-flow for one or many real estates is produced if you have the "page" "Fastigheter i portfölj / Properties in portfolio" active on your configuration. The data entered on that page produces output on a "result view tab" in the application as well as a printable pdf-report.

Picture from GUI - Fastigheter i portfölj / Properties in portfolio

The information entered (imported) to this page produces a casflow report that is presented in the GUI on the tab "Kassaflöde fast / Cash flow r.est"

The information also producse a printable pdf-report for each property that is included in the case as well as an aggregated cash-flow for all the properties.

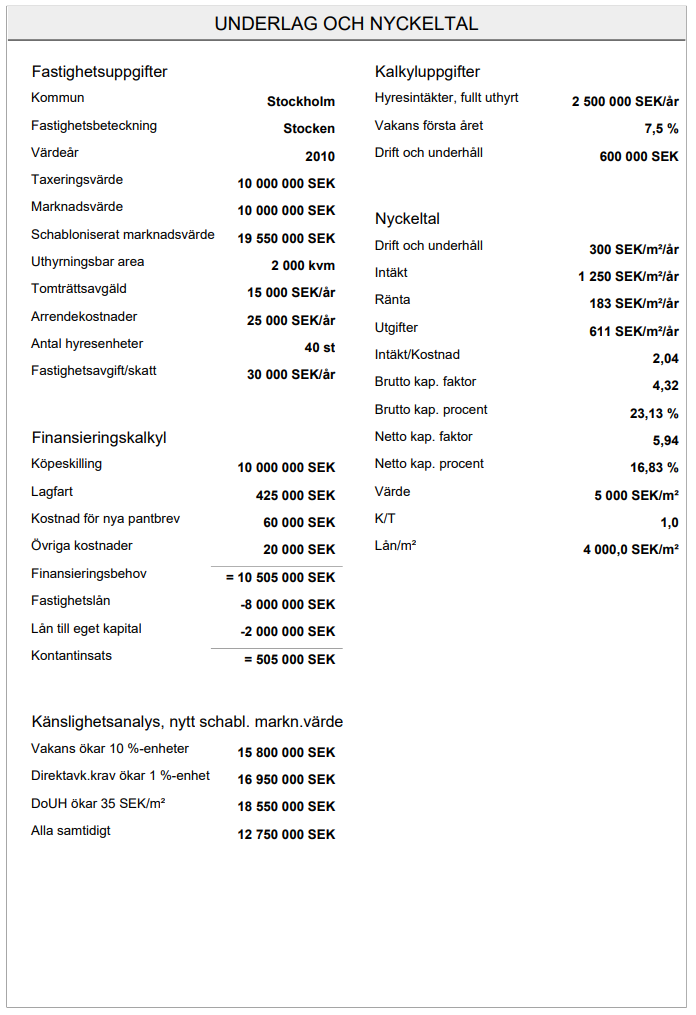

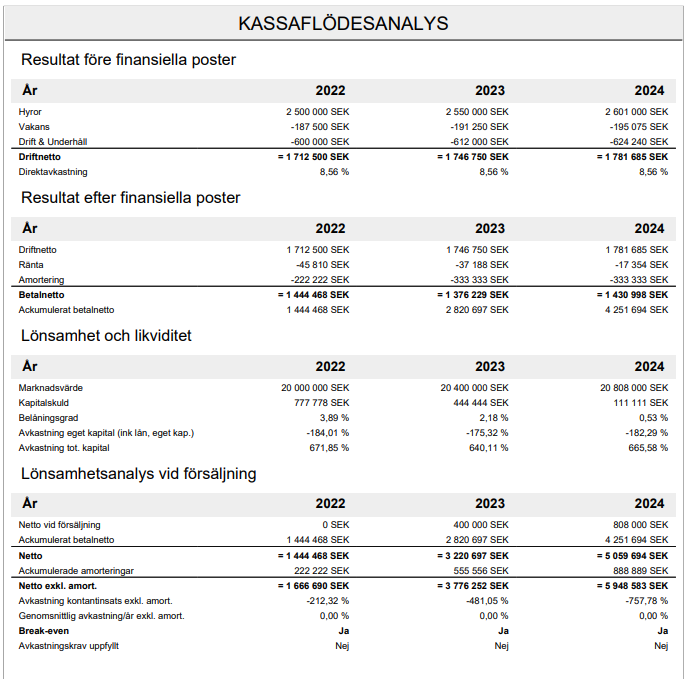

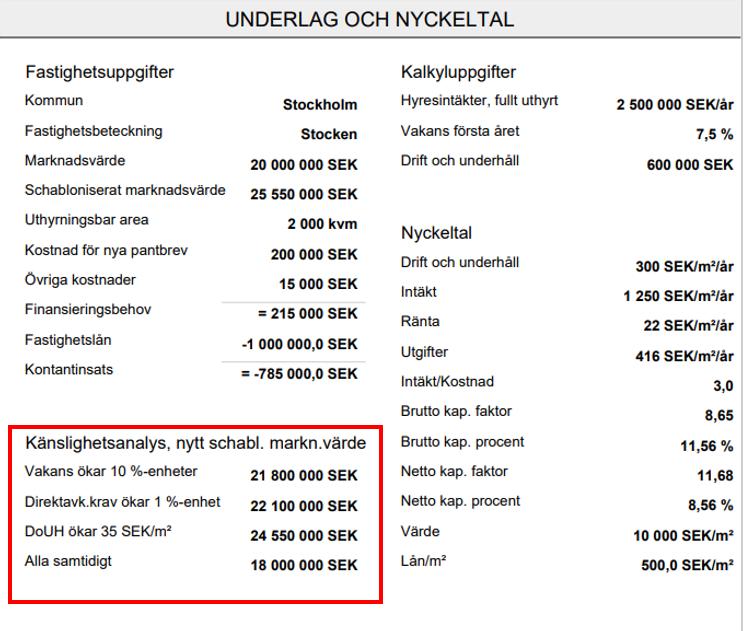

Example Pdf below

Definition of KPI:s in the cash flow report (printable pdf)

KPI |

Definition |

|---|---|

Drift och underhåll / Operating costs |

Operating costs divided by the property's total area |

Intäkt / Revenues |

Total revenues for the property |

Utgifter / Expenses |

Total cost for the property |

Intäkt/kostnad - Revenues/expenses |

Total revenues divided by total cost |

Brutto kap. faktor / gross capitalization factor |

The ratio between a property's market value and its gross revenues |

Brutto kap. procent / gross capitalization percent |

The ratio between a property's market value and its gross revenues in percent |

Netto kap. faktor / net capitalization factor |

The ratio between a property's market value and its net operating income |

Netto kap. procent / net capitalization factor |

The ratio between a property's market value and its net operating income in percent |

K/T |

Market value divided by Assess value (taxeringsvärde) |

Värde / Valuation |

Market value divided by total area (squaremeter) |

Lån/kvm - Loan / Squaremeter |

Loan amount for the property divided by total area (squaremeter) |

Direktavkastning % / Direct return % |

Net operating income divided by market value |

Avkastning eget kap (inkl. lån eget kap.) / Return own cap (incl. loan own cap.) |

Sum operating net divided by "cash or equivalent" in percent |

Avkastning totalt kapital / Return on total capital |

Sum operating net divided by total cost in percent |

Avkastning kontantinsats exkl amort. / Return on cash investment excluding amortization |

Net after sale (excl amort) divided by capital contribution in percent |

Genomsnittlig avkastning exkl amort. / Average return excluding amortization |

Return on cash investment excluding amortization divided with the number of years from the acquisition |

Break even |

Yes when Net after sale (excl amort) is greater than zero |

Avkastningskrav uppfyllt / Return requirement met |

Yes when "average return excluding amortization" is greater or equal to 10% |

Schabloniserat marknadsvärde / Standardized market value

We use the Net capitalisation method (Nettokapitaliseringsmetoden) to calculate a standardized market value per property. The formula is:

"Net operating income / direct return requirement = standardized market value"

We use the first year that int the cashflow report for this calculation and if it is part of a year we recalculate it to a full year equivalent and the eventual one time costs (i.e mortgage costs, stamp duty etc) are eliminated from the net operationg income. The direct return requirement value is the one that is entered on the page "Property in portfolio" see below

Sensitivity analysis (Känslighetsanalys) new standardized marketvalue

We make a sensitivity analysis where we stresstest operating costs, vacancy limit, direct return requirement and than all of these parameters at once. The levels we use to stresstest are at this moment hardcoded but can be changed if required per configuration.

Picture from the cash-flow report