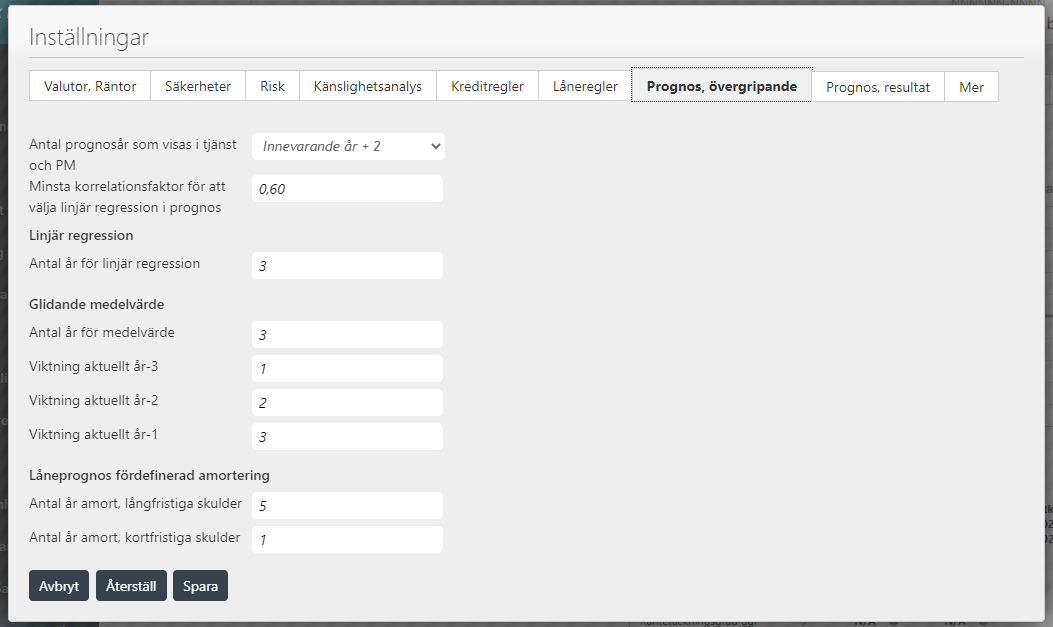

Here, settings are made for the different forecasting methods used in the service. These are decided and changed by the Credit Department at the bank.

Depending on the values given here, it is stated how the forecasts are to be calculated and which method is to be used if it is the method Auto, linear regression or weighted rolling average.

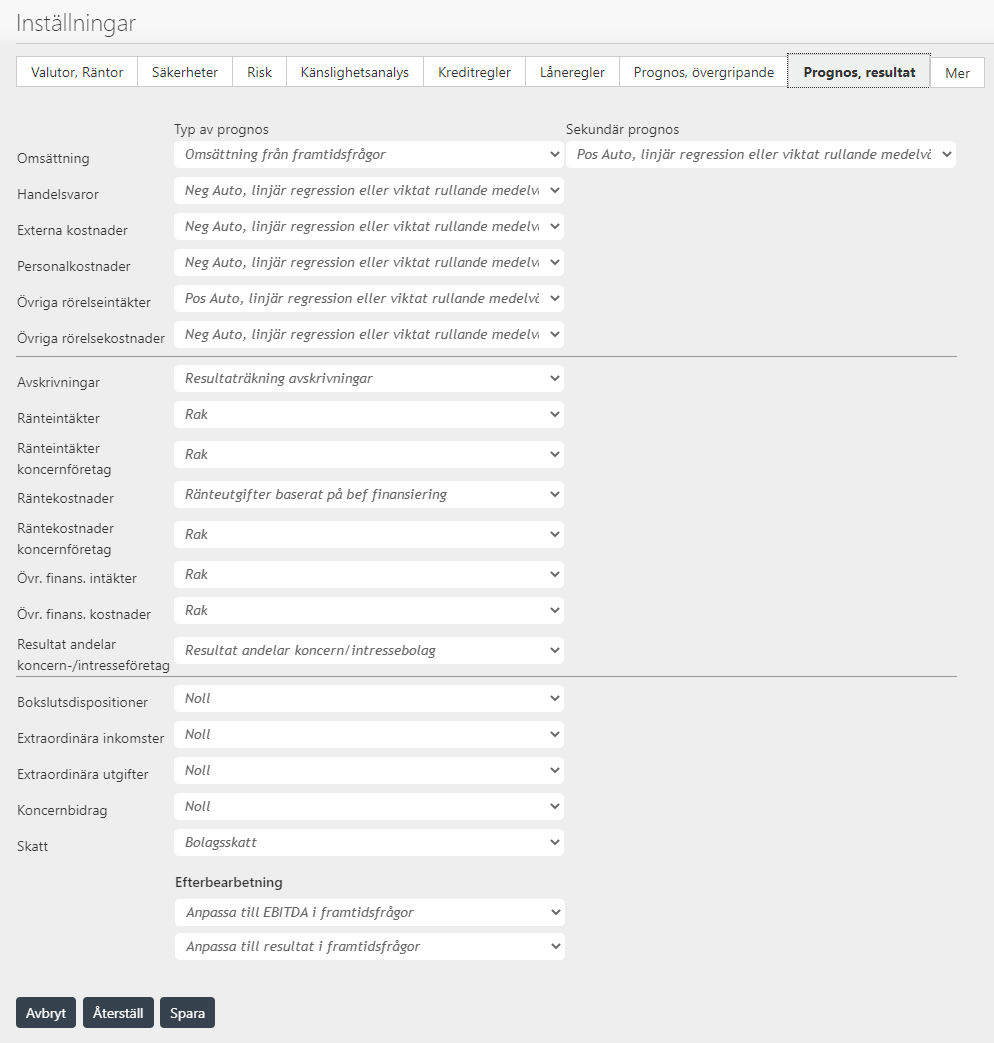

We have a generally configurable parameter-controlled forecast engine where you can specify the type of forecast to be made per field in the balance sheet / results, we currently have support for the following:

Auto linjär regression eller viktat rullande medelvärde / Auto, linear regression or weighted rolling average (depending on correlation factor)

Linjär regression / Linear regression

Viktat rullande medelvärde / Weighted rolling average

Rullande medelvärde / Rolling average

Rakt / Straight

Omsättning från Framtidsfrågor / Turnover from "Framtidsfrågor"

Låneprognos baserat på bef. finansiering / Loan forecast based on existing Loan

Tillgång med avskrivning / Assets with depreciation

Avskrivningar / Income statement depreciation

Bolagsskatt / Corporation tax

Ränteutgifter baserat på bef. finansiering / Interest expenses based on existing financing

Låneprognos fördefinierad amortering Loan forecast based on predefined amortization

There is also a possibility to define if a value is supposed to always be positive or negative. If you for instance choose "Pos linear regression" the value for the forecast can never turn negative and the opposite if you choose "Neg linear regression".

Picture from Settings / Inställningar

In this view you set the parameters for the basic forecast methods that is applied for Income statement and Balance sheet

Settings for posts in Income statement

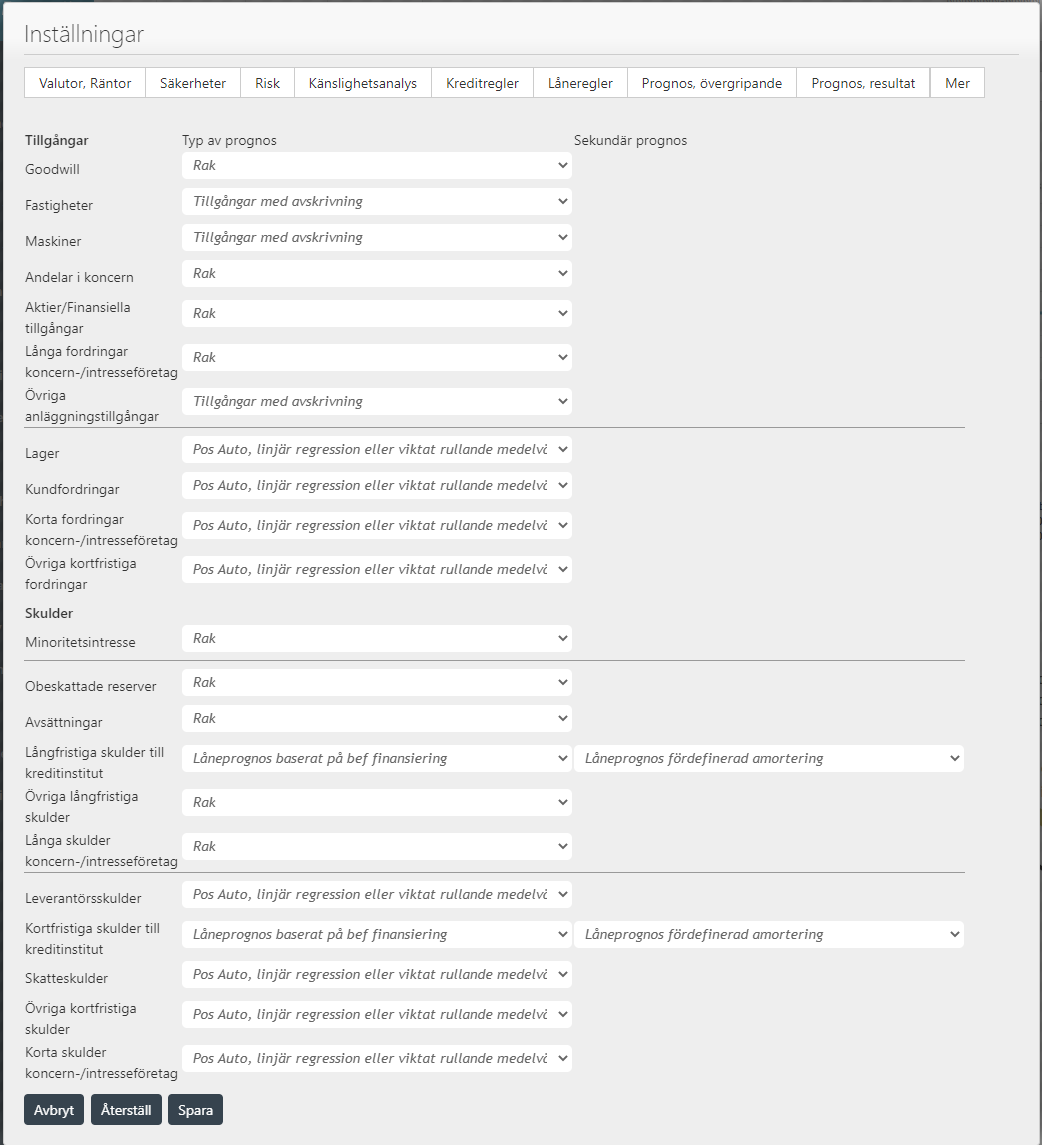

Settings for Assets in Balance sheet

Here is the view for defining wich method that should be applied for each post in the Balance sheet