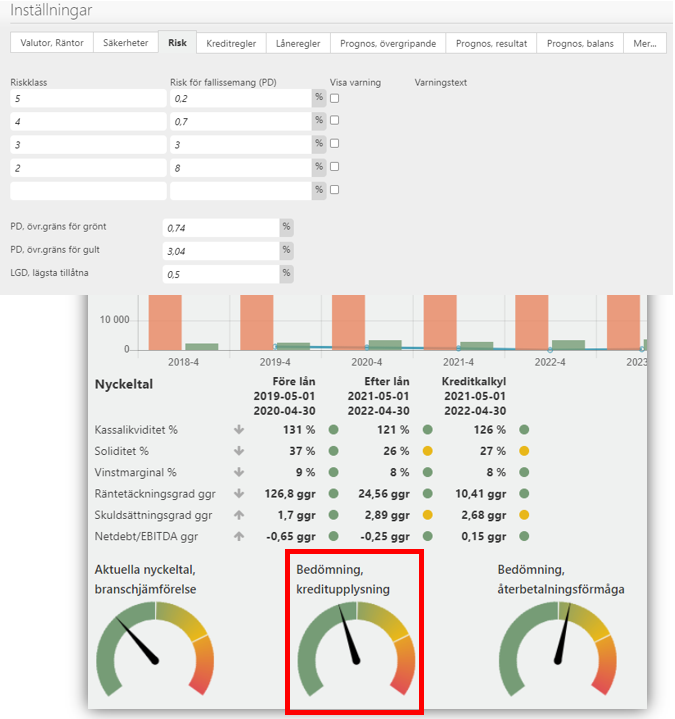

Here are the settings that indicate what risk a certain value from the credit reporting company generates. The Credit Rating Assessment Meter gets its information regarding whether it is green, yellow or red from these settings.

Explanation of the values and what risk the company is deemed to have is based on Kreditupplysningsföretaget's official assessment regulations.

Green - very low or low risk of bankruptcy

Yellow - Normal risk of default

Red - high or very high risk of bankruptcy

It is here the bank can set it's minimum value for LGD

Picture

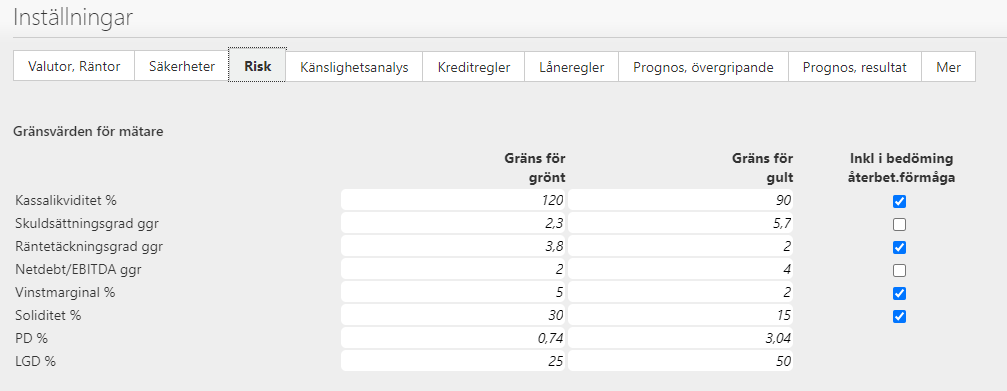

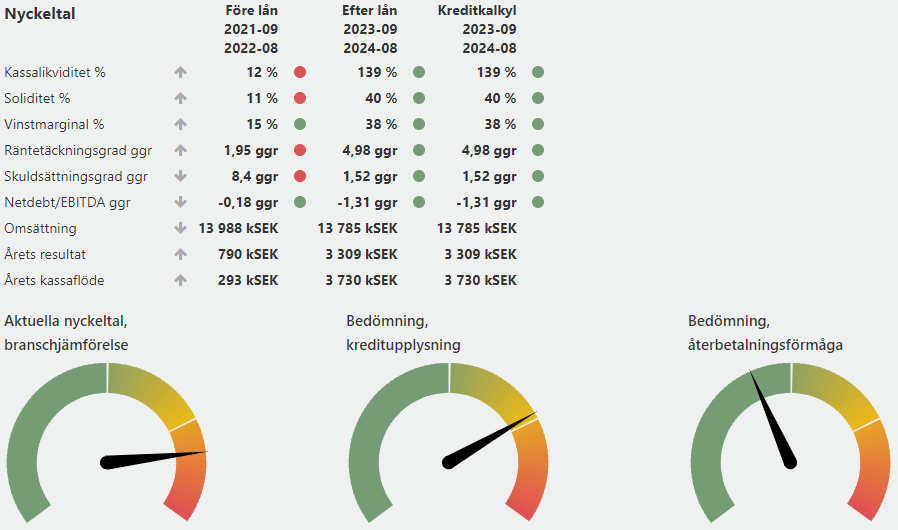

Settings of the meters

The bank sets the levels for the KPI:s that are to be considered as Green (good), Yellow (Ok) or Red (Bad).

You can choose which KPI:s you want to be included in the meter “Assessment repayment ability” / Bedömning återbetalningsförmåga.

The levels above effects how the meters below will be presented (green, yellow or red)

Conversion from PD to Riskklass

The PD number that a credit scoring company (UC, Bisnode etc) provides can be automatically converted into the banks internal "Riskklass" and presented in the "Kredit-PM".