This is an optional module

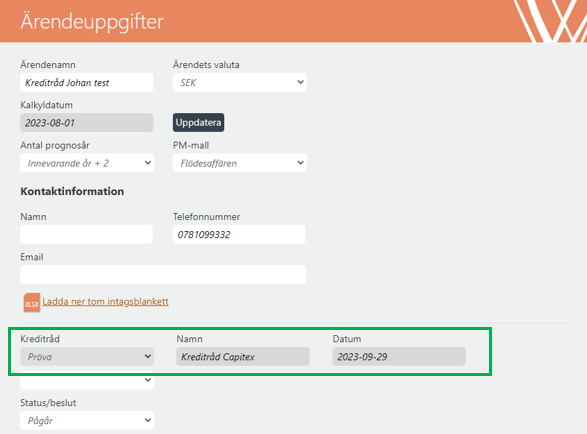

Credit advice Capitex is a functionality that gives a recommendation in a financial application. The bank can choose which parameters that needs to be fulfilled in order to receive a specific Credit advice from Capitex in plain text. The Credit advice is presented on page Case information / Ärendeuppgifter and can also be mirrored in other places in GUI and Credit decision report

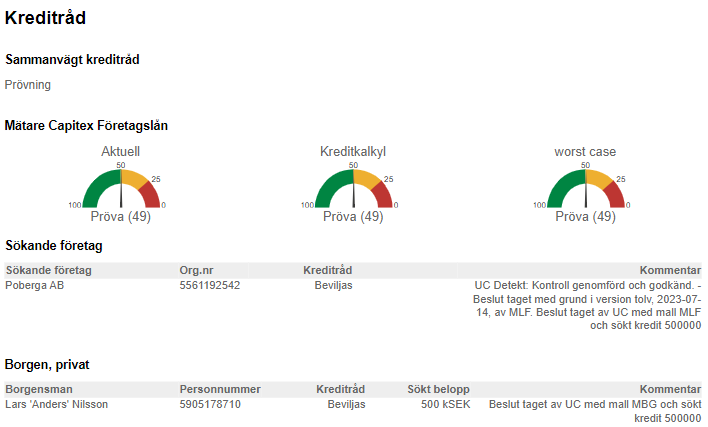

The bank decides which parameters that needs to be fulfilled in order to receive “Approved”, “Consideration” and “Denied” and Capitex Credit Advice is then presented for the case handler to guide that person in order to have faster and better quality regarding decision making.

Below the Credit advice Capitex each case handler can set their decision so that both automatic credit advice and advice from case handler are presented.

Parameters that usually are use for creating Capitex Credit Advice are for instance a mix of below:

Repayment ability meter

Credit calculation / Kreditkalkyl meter

Credit advice from Credit information company such as UC, Bisnode etc

Sensitivity analysis - Capitex

Below is an example on how the above parameters can be presented in GUI and Credit decision report