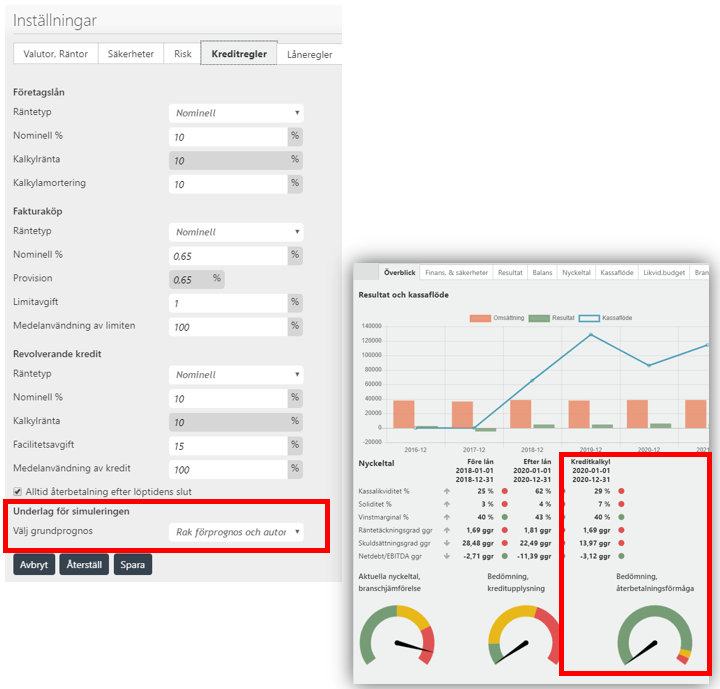

Bank can choose between several different so-called Basic Forecasts that control how the meter "Bedömning återbetalningsförmåga" / "Assessment of repayment ability" and the key figures are developed for "Kreditkalkyl" / "Credit calculation":

"Rak förprognos" / "Straight" pre-forecast and "Automatisk efterprognos" / "Automatic post-forecast" - if this is selected, the forecast for Credit Calculation is calculated on the most recent “Actual-year” / historical-year on the data base and takes this information in a straight forecast, ie the same data for future forecast years. To this straightforward forecast are added costs for financing according to those entered in Settings, ie the image on the left.

"Justerad förprognos" / "Adjusted pre-forecast" and "Automatisk efterprognos" / "Automatic post-forecast" - the program runs on the data for RR, BR that are entered on the Forecast pages, ie the automatically calculated or those that are entered manually and on the interest rates, repayments, etc. specified in Settings and Credit Rules

"Justerad för-/efterprognos" / Adjusted pre-/ post forecast" - the program runs on the information for RR, BR that is entered on the pages Forecast, ie the automatically calculated or those that are entered manually and on the interest, repayments, etc. that are entered on the page Loan applied for, ie the actual costs

"Automatisk förprognos" / "Automatic pre-forecast" and "Justerad efterprognos" / "Adjusted post-forecast" - the program runs on the data for RR, BR that are entered on the Forecast pages, ie the automatically calculated or those that are entered manually and on the interest rates, repayments, etc. specified in Settings and Credit Rules (ie the same as above)

Picture