Introduction to the software and how to use it

Below is a simplified description on how to test the basic functionality in the program:

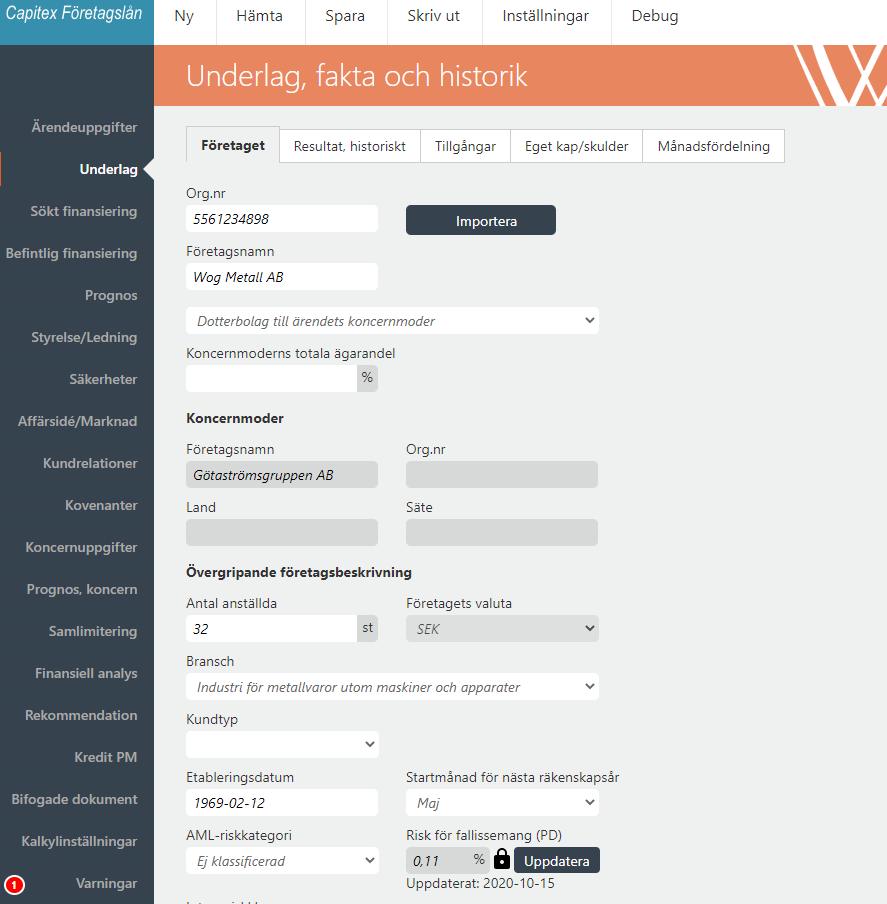

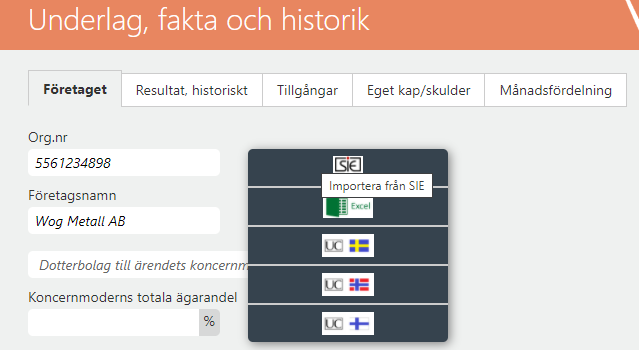

1, Start a new case by entering the org.nr for a company: and click "Importera" / "Import". Import is done via UC, SIE or an Excel-form. You can also enter all the data manually.

2, If needed import additional data such as SIE-file (accounting data) or "Kundintagsblanektt" / "Customer intake form". Or make manual adjustments.

3, Månadsfördelning / Monthly distribution - check the box and enter (or import information from SIE, "Kundintagsblankett" / "Customer intake form") to get the cash flow per month

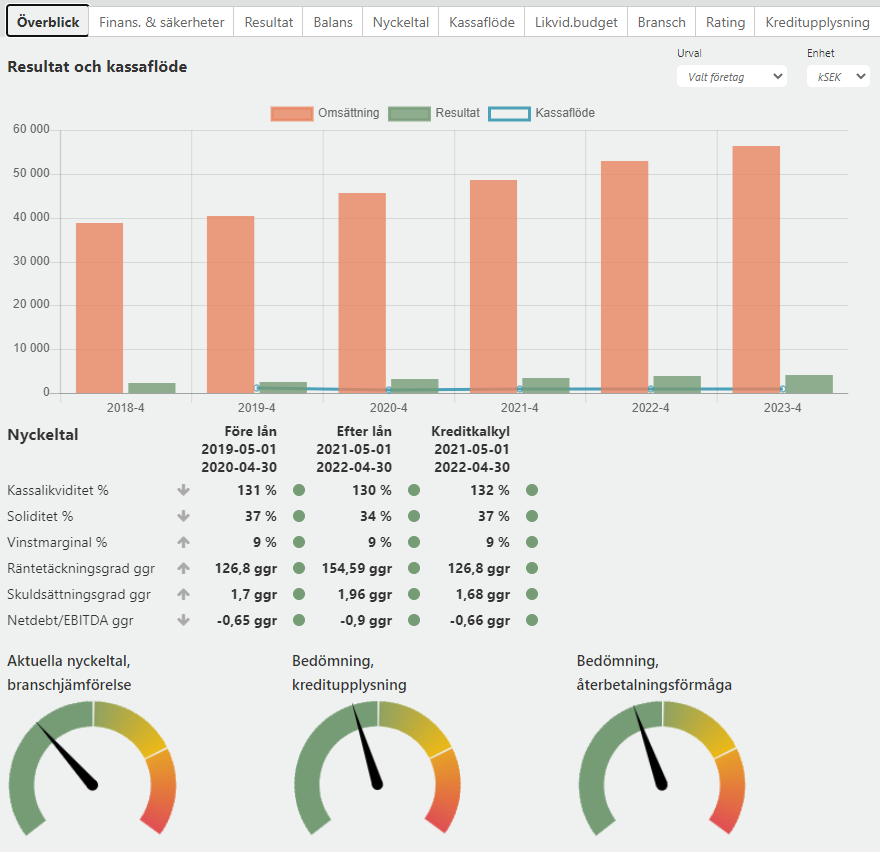

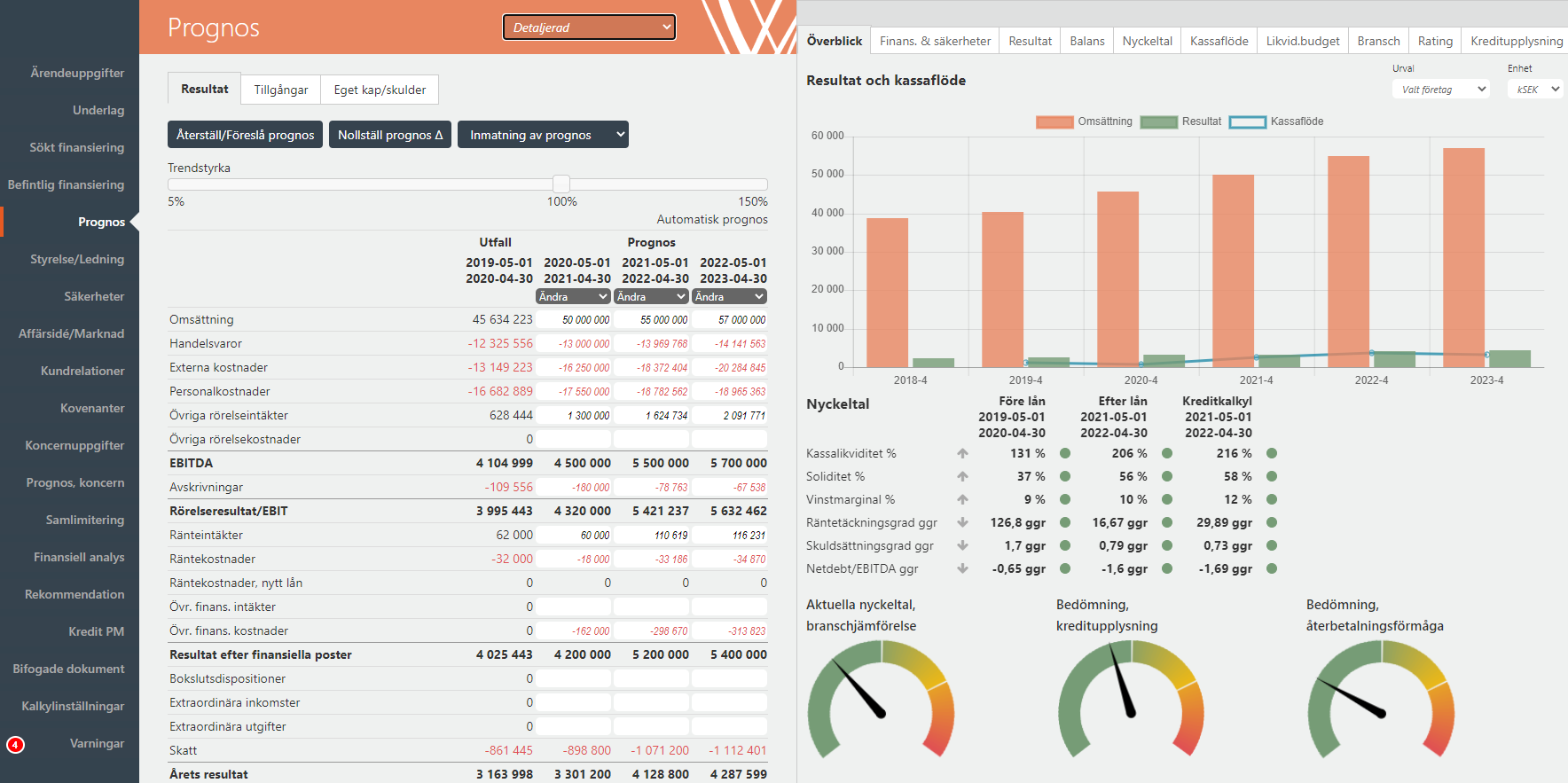

4, Check the information about the company by looking at the meters and tabs regarding Income statement, Balancesheet, Cashflow etc.

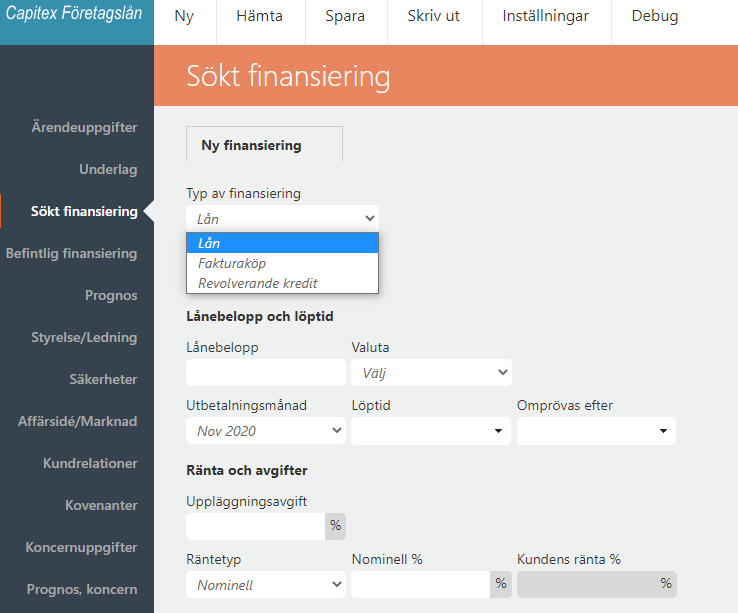

5, Enter data about the financing the company is applying for and see on the tabs on the right how this affects Incomestatement, Balancesheet, Cashflow etc.

6, "Prognos" / "Forecast" - adjust the numbers on the Prognos / Forecast page to see how key figures, meters, diagrams change when new data is entered. Choose between "Prognos enkel" / "Forecast simplified" or "Prognos detaljerad" / "Forecast detailed"

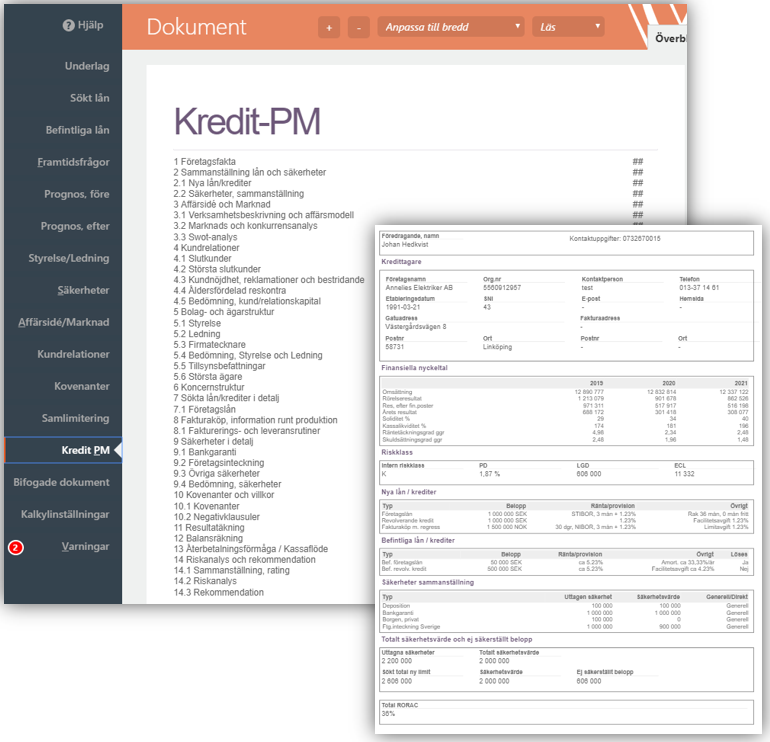

7, "Kredit-PM" / "Credit-memo" - go to the page "Kredit-pm" / "Credit-memo" and se how your credit decision report looks like after you have entered your data.

8, "Ärendeuppgifter" / "Case information" - set a name for the current case, add contact info and update the progress of the case.

Roles

Typical users of the software are:

Credit administrators at bank

Corporate advisor at bank

Financial analysts at bank

Credit committee at bank

Workflow

A simplified description of a typical workflow for a credit application that is handled in Capitex Business Loan when the program is used as a "stand alone" program. It is also possible to integrate the system to a banks other core banking systems; such as CRM, BPM, Loan administration etc.

Start a case and import / enter the required information in order to be able to make a recommendation for a decision maker at bank

Set the status to "Klar för granskning" / "Ready for audit" if a credit analyst is supposed to audit the credit decision report and save the case

Set the case status to "Granska" / "Audit" when it is ready for audit by the credit committee and save the case

The credit committee set the status to "Beviljas"/"Approved", "Avslag"/"Denied" or "Komplettera"/"Complete" and saves the case

If an approved case is subject to yearly overview/prolongation the bank can search for cases in Status "Omprövningsdatum"/"Review date" and find cases that are subject for review/prolongation