If you want to make calculations regarding an investment in a real-estate you need to connect the real-estate with the applied loan

First of all, to connect a real-estate as an investment the purchase of the real-estate have to be in the future. You enter information about purchase day either on Säkerheter/Colleteral page or "Fastigheter i portfölj" / Real estate in portfolio page. If the real-estate is used as a collateral you probaly will enter the information on the Säkerheter/Collateral page and the two pages shares information so if you update it on either one the other will change as well.

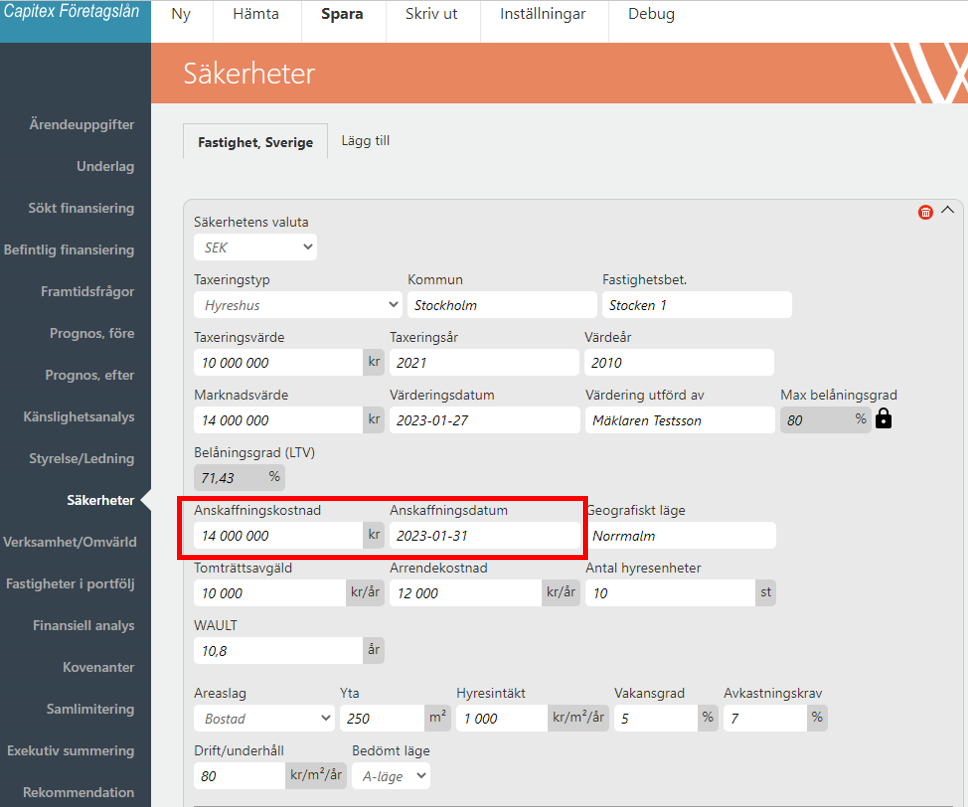

Picture below shows the purchase date

Enter the amount the real-estate is purchased for and then enter which date the chage of ownership will occur. This info can be entered on both the "Säkerhet/Collateral" page and the "Fastigheter i portfölj / Real estate in portfolio" page.

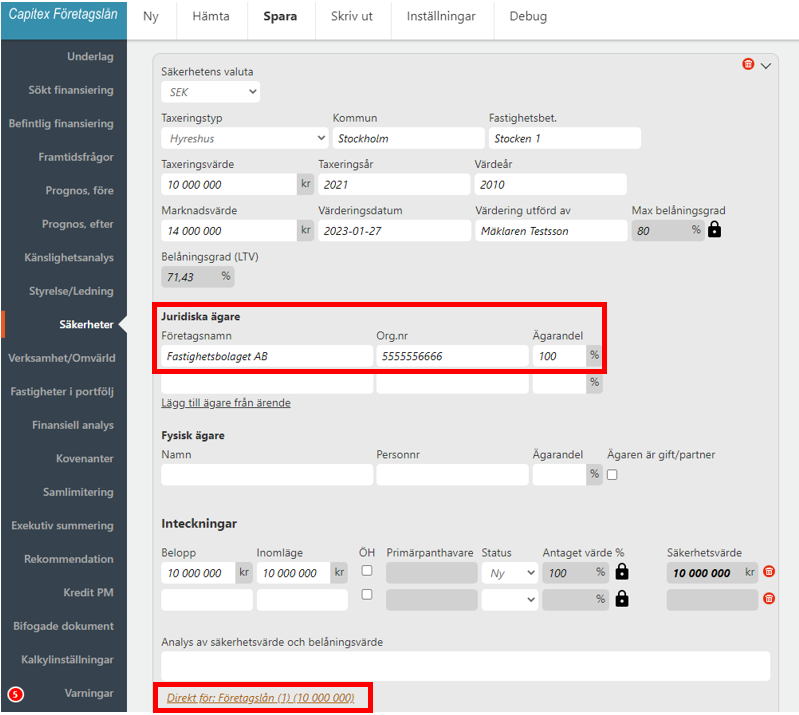

Picture below shows information about owner

In order to connect the real-estate to the specific company as an owner you enter the information about who the owner is. This info can be entered on both the "Säkerhet/Collateral" page and the "Fastigheter i portfölj / Real estate in portfolio" page. You have to choose this as a direct collateral in order for the real-estate to be considered as an investment for an applied loan

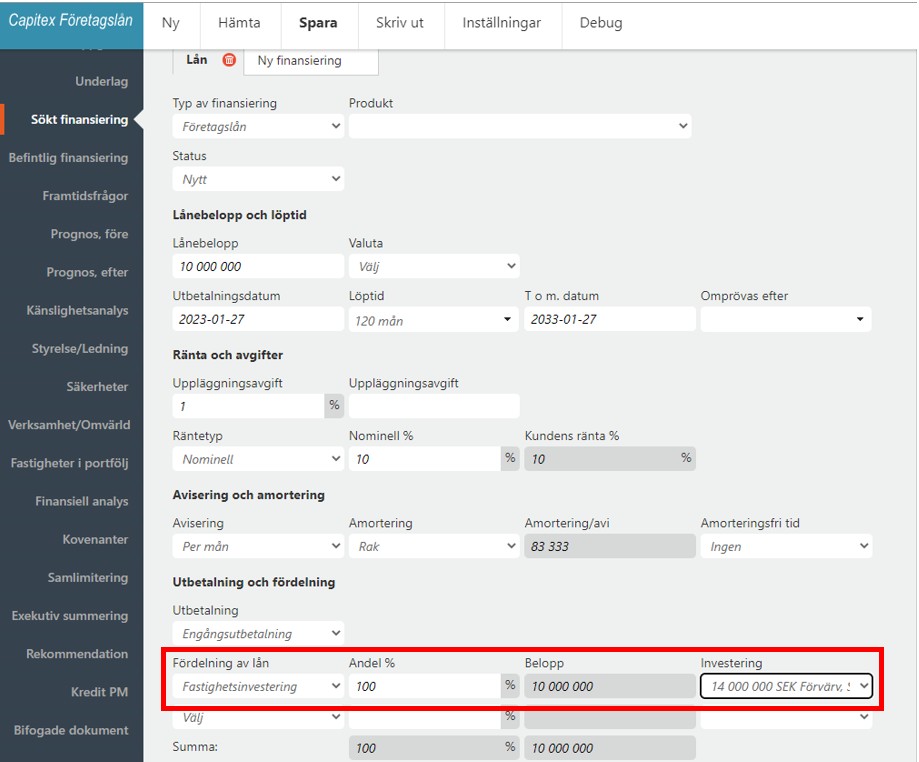

Below picture shows how to connect a real-estate to a loan

In order to connect the real-estate as an investment for a loan you have to choose "Fastighetsinvestering / Real estate investment" as the "Fördelning av lån / Distribution of finance".

When the stages above have been executed the real-estate is connected as an investment for the acquiring company and the net operating income for the real-estate will effect the acquiring comany's cashflow, income statement and the balance sheet.

If you want to add a loan for downpayment for the property just follow every step above except connecting the property as a Collateral.