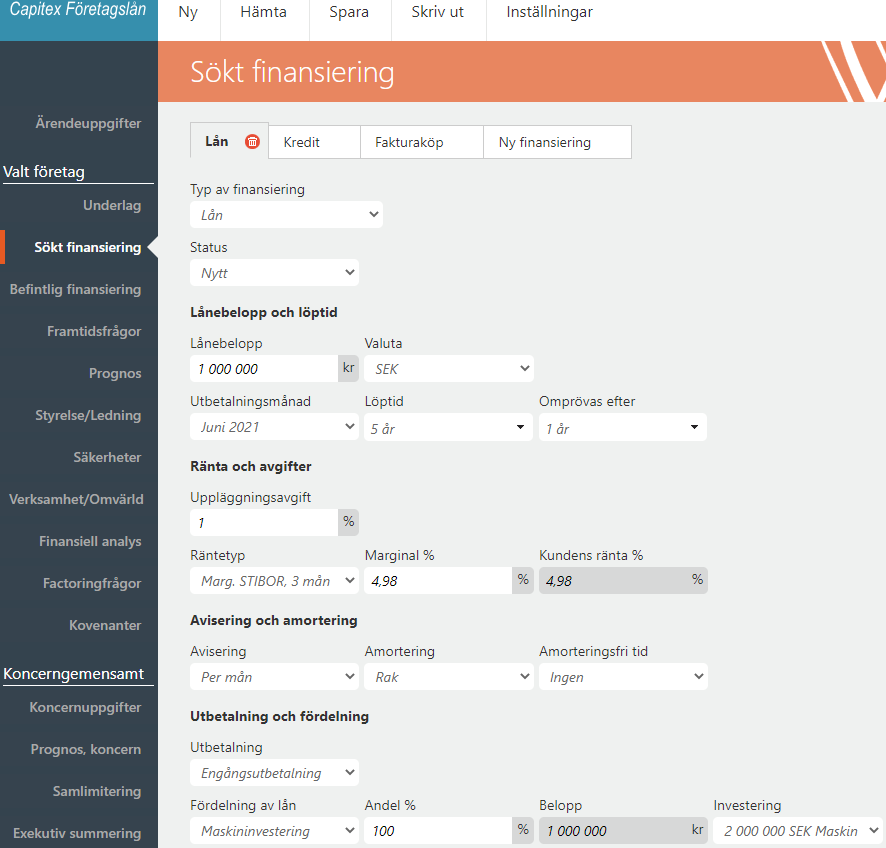

On the Sökt finansiering / Applied financing page, you state which financing (s) the company is applying for.

It is possible to register four different financings at one time / credit preparation per comany in the case.

The different types of financing are:

Lån / Business loans

Fakturaköp / Invoice purchases

Revolverande kredit / Revolving credit

Note! Vitec adds more types of financing if there is a request for it

Definitions:

"Räntetyp" / "Interest rate type" - Nominal - enter the actual interest the customer must pay Margin + Ibor - specify which Ibor is to be linked to the financing and set the margin. This means that interest rate rises and interest rate declines accrue to the company.

"Omprövas efter" / "Re-examined", (read more in subpage to this chapter)

"Kundens ränta" / "ustomer's interest" - is the interest that the customer will actually pay as of today's date

"Uppläggningsavgift" / "Setup fee" - one-time setup fee and is stated as% of the amount applied for Nominal facility fee - this is the interest the customer has to pay for the unused part of the credit limit

"Avisering och amortering" / "Notification and amortization" - how is the financing repaid, periodisation and type of amortization (described in more detail in a subpage to this chapter)

"Prognos" / "Forecast" - used to calculate forecasts regarding RR, BR, Key Figures and Cash Flow. Indicate how large a share of Revolving credit and / or Invoice purchases the company is judged to use over a year. Guideline is 70% for Invoice Purchases and 70% for Revolving Credit

"Utbetalning och fördelning" / "Payment and Distribution" - specify the proportion of financing to be used for the various choices, eg 50% Machine Investment and 50% Expansion of inventory. This is used for forecasting and that you see in more detail what the loan is to be used for.

Investering / Investment - here you specify what the loan is to be used for and how large the total investment is, ie if the company takes part of the equity to carry out the investment

Picture from the program

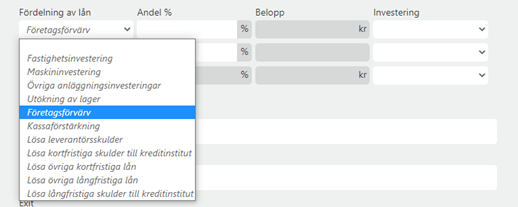

Fördelning av lån Loan distribution

Picture

This dropdown menu gives you the opportunity to choose what the financing will be used for. You must choose that the loan is divided between the various predefined choices. If you do not make a choice or you do not distribute 100%, the part that has not been distributed will be added as "Kassaförstärkning" / "Cash". If the loan is to be used to repay something on the debt side, the corresponding amount will decrease on the debt side and up to the amount contained in the Forecast for this item. If the debt is smaller, the excess amount will end up in the "Kassa och Bank" / Cash and Bank

The choices that exist are and the effects are visible on the balance sheet in addition to the loan being added to the debt side are:

"Fastighetsinvestering" / "Real estate investment" - The item properties in the balance sheet increases by the corresponding amount

"Maskininvestering" / "Machine investment" - The post "Maskiner" / "Machines" in the balance sheet increases by the corresponding amount Increase in inventory

"Utökning varulager" / (Expansion of inventories - Varulager / Inventories in the balance sheet increases by the corresponding amount

"Företagsförvärv" / Acquisition of a company - if the investment is an aquisition of a company you add that company to the case (se more below) and register equity ownership and purchase price

"Kassaförstärkning" / "Cash reinforcement" - The item "Kassa och bank" / "Cash and bank" in balance sheet increases by the corresponding amount

"Lösa leverantörsskulder" / "repay accounts payable" - the item "Leverantörsskulder" / "Accounts payable" in the balance sheet decrease by the corresponding amount

"Lösa kortfristiga skulder till kreditinstitut" / "Repay short term loan to credit institution" - the item "Kortfristiga skulder kreditinstitut" / "short term loan to credit institution" decreases by the corresponding amount

"Lösa övriga kortfristiga lån" / "Repay other short-term loans" - the item "Övriga kortfristiga lån" / "Other short-term loans" in the balance sheet decrease by the corresponding amount

"Lösa övriga långfristiga lån" / "Repay other long-term loans" - the item "Övriga långfristiga lån" / "Other long-term loans" in the balance sheet decrease by the corresponding amount

"Lösa långfristiga skulder till kreditinstitut" / "Repay long term liabilities to credit institutions" - the item "Långfristiga skulder till kreditinstitut" "Long term liabilities to credit institutions" in the balance sheet decrease by the corresponding amount

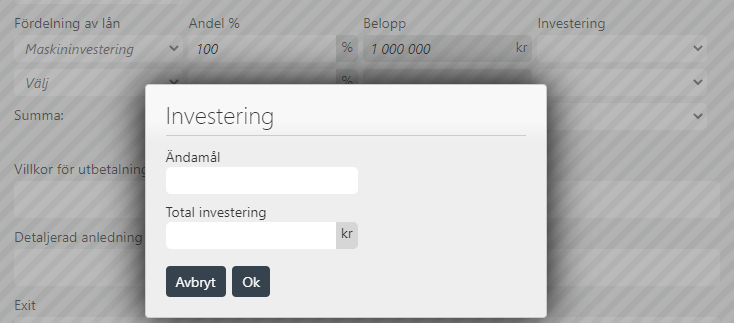

Investering / Investment

Add information about the total investment so that the bank can see how much own equity (if any) the company uses for the investment

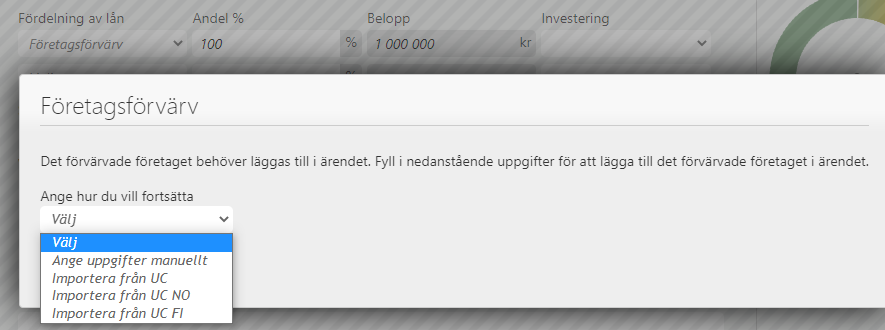

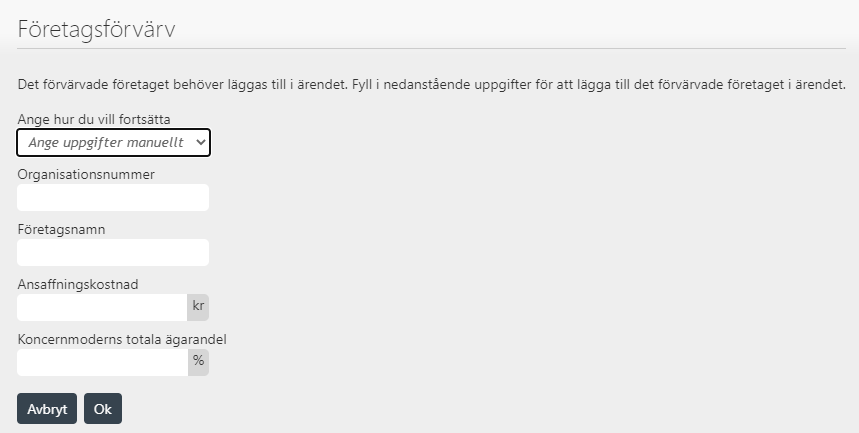

Företagsförvärv / Acquisation of a company

If the investment is for an acquisation you need to add that company to the case. You can do that by importing it from a Credit scoring company or manually register the information.

When you add the company and enters the equity ownership for the group mother and the purchase price a proforma analysis over the income statement and balance sheet is made for the new group.