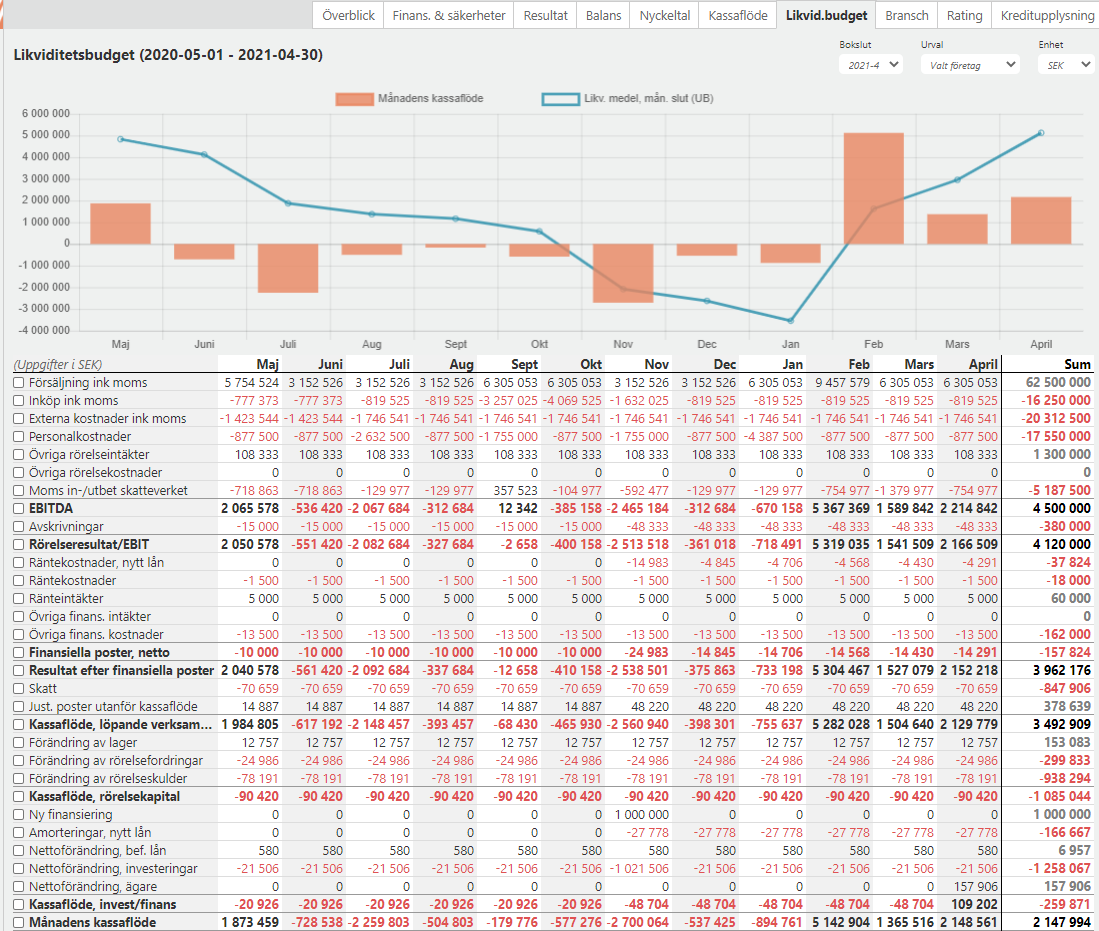

Here you see the outcome of the percentage distribution per month that you registered earlier on the page Underlag and "Månadsfördelning" / Monthly distribution. You can also have imported the excel form "Kundintagsblankett" where the corporate customer has filled in the information and you have uploaded it to the application.

In order for this information to be correct, you must have checked that the information on the Forecast page is correct on an annual basis, ie that Sales and costs are correctly stated for each year.

Note! Sales, Purchases and External costs are shown here including VAT, unlike in the Income Statement. The reason is that VAT is paid and received directly and then adjusted via the VAT return.

The effects of the applied for funding have a direct impact on the liquidity budget and what the financing is to be used for (investment, repayment of loans etc.).

Note! If you think that the figures do not correspond to the documentation / budget / forecast the corporate customer has submitted, the explanation is often that they have missed, for example, VAT effects and payment periods (received and submitted credit period). These effects have a very large impact on cash flow. It is also common for the company to have specified certain items including VAT and certain excluding VAT. Then our calculations are made according to established regulations for forecasts, which means that in principle it will never fully correspond to 100% with the company's own submitted information.

Picture from the software application